July 28th, 2023 | by Maciej Rohleder

Navigating the Future: Key Technologies Transforming FinTech and RegTech by 2030

Table of contents

The landscape of finance and regulation is undergoing a rapid transformation driven by emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and more. Mastering them – while ensuring robust security and resilience – is an enormous challenge, but it is necessary. As we delve deeper into this article, we aim to spotlight these groundbreaking technologies’ critical role in amplifying business performance and reinforcing compliance. And here’s a promise: The future of finance will build upon the fundamental principles of financial security to create a more protected, efficient, and resilient ecosystem.

What You’ll Learn From This Article?

The Rise of AI, ML, and LLM in FinTech and RegTech – Kicking things off with how AI, ML, and Large Language Models (LLM) are reshaping the financial sector, boosting efficiency, slashing costs, and improving customer experiences.

DeFi and Blockchain’s New Era – A three-part special delving into the sweeping impacts of blockchain and DeFi, their growing adoption in the FinTech and RegTech arenas, and the hurdles in the pathway to their mainstream acceptance.

The Potential of Hyper Automation and Deep Learning – Next up, we’re spotlighting two game-changers poised to turbocharge the FinTech and RegTech landscape.

Quantum Computing – Here we’ll delve into the quantum realm, a place where encryption gets a supercharge and predictive analysis could leap into the future.

Building a Strong Foundation for FinTech and RegTech – This part is crucial. We’re explaining why a sturdy foundation is just as important as innovation, especially when it comes to balancing operational efficiency and compliance.

/

The Rise of AI, ML, and LLM in FinTech and RegTech

The adoption of AI, ML, and LLM in FinTech and RegTech is propelling a new wave of transformation. At CSHARK, we predict that these technologies will reshape financial institutions, drive efficiency, reduce operational costs, and enhance customer experiences.

| Key Area | Role of AI, ML & LLM | Examples of usage |

| Efficiency | Improving decision-making speed and accuracy | ML algorithms can sift through vast data sets at astonishing speed, identifying trends and patterns far beyond human capabilities. This will give financial organizations the ability to estimate risks and make informed decisions automatically. For end users, it will mean a short time to resolve. |

| Cost Reduction | Minimizing errors, reducing operational costs, and foreseeing financial risks | AI automates repetitive tasks accurately. Its predictive abilities can identify and mitigate financial risks, preventing losses. LLMs, by enhancing communication and operations, also contribute to cost savings. |

| Personalized Financial Assistance | Leveraging data analysis for tailored financial advice | AI and ML analyze spending habits and financial data to formulate personalized advice, while LLMs translate these complex findings into simple, actionable strategies for the user. |

| Automated Customer Support | Enabling 24/7 multilingual and multi-accessible support | AI underpins the responsive nature of chatbots, ML helps in understanding and learning from customer interactions to improve future responses, and LLMs provide human-like conversation fluency. |

| Creditworthin-ess Assessment | Expanding credit analysis beyond traditional measures | ML algorithms analyze non-traditional data to gauge creditworthiness, while AI ensures real-time processing of this data. LLMs could then explain these credit ratings in an easily understandable manner. |

| Language Translation and Accessibility | Enhancing multilingual support and access for diverse users | LLMs perform the task of translating financial terminologies across languages, and AI-driven speech-to-text or text-to-speech functionalities augment the accessibility. |

| Bias Detection and Mitigation | Identifying and addressing biases in financial decisions | ML identifies patterns of bias in large datasets, AI systems apply these learnings in real-time operations, and LLMs communicate these processes transparently to ensure fairness. |

| Financial Education and Literacy | Personalizing education and simplifying financial concepts | AI determines individual learning preferences, LLMs curate personalized and understandable content, and ML algorithms learn from users’ interaction with the material to improve future educational offerings. |

Take “assisted” AI/ML as an example – a concept where machines perform complex analyses, but specialists are still at the helm, validating and approving results. Similarly, when used responsibly with human oversight, LLMs can significantly augment decision-making capabilities and operational efficiency in the financial sector.

Far from being mere flashes in the pan, these transformations are solidly grounded in robust industry growth projections.

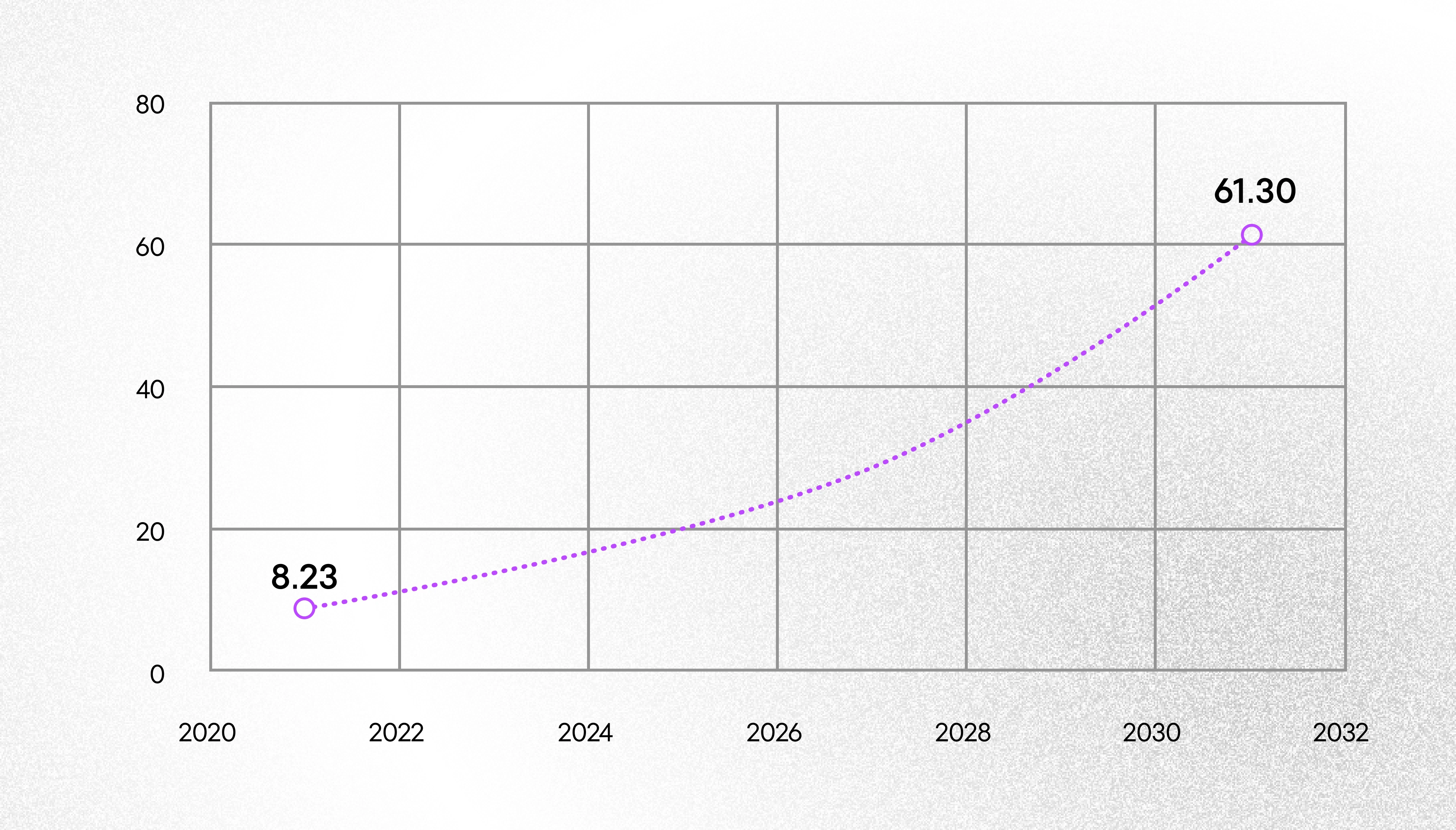

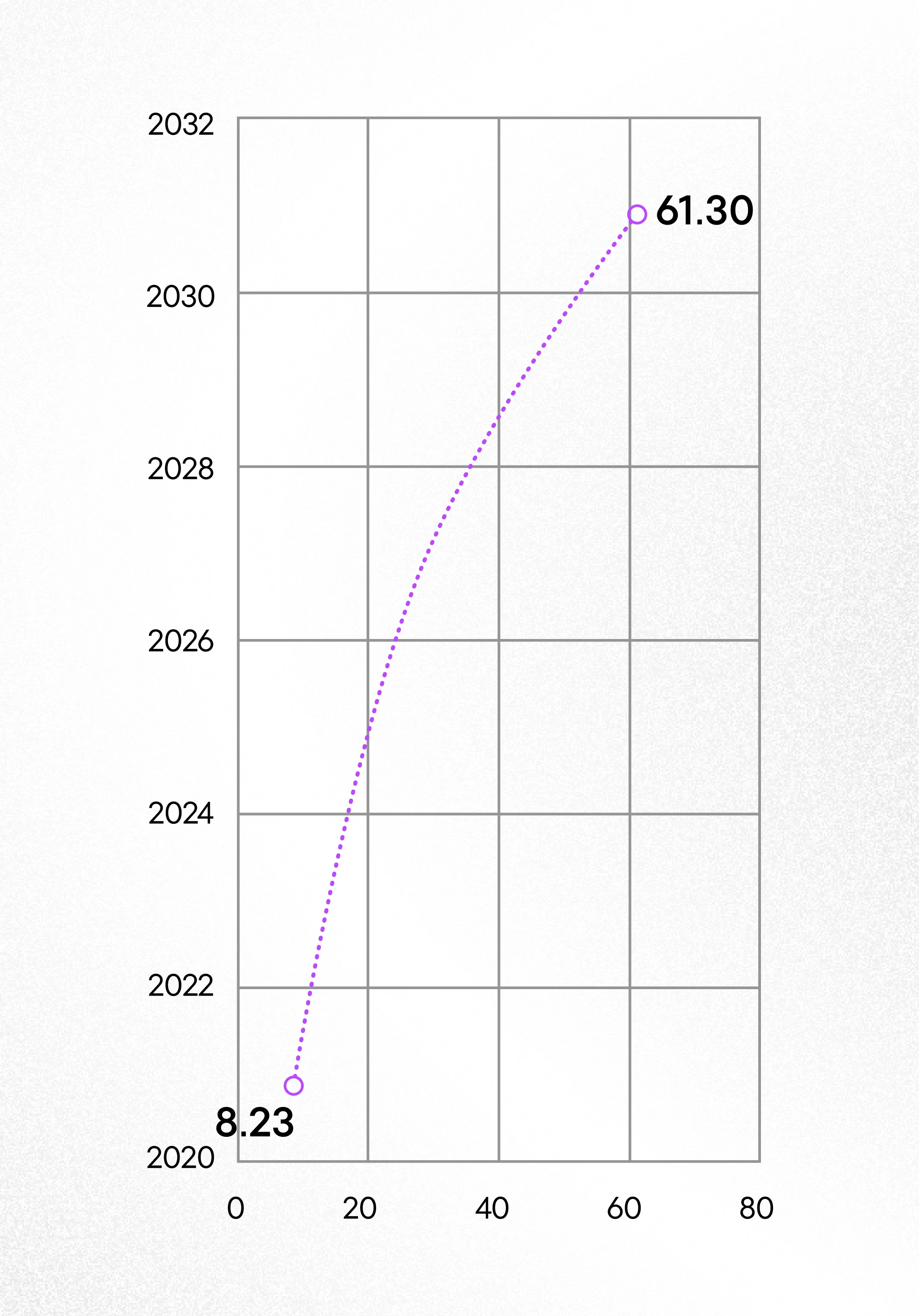

According to Allied Market Research, the global AI in the FinTech market is set to surge, moving from $8.23 billion in 2021 to a forecasted value of a staggering $61.30 billion by 2031. Such impressive growth signals a promising future and serves as a compelling reason for businesses to invest time and resources into AI and ML technologies.

The global AI in the FinTech market (Billion USD)

Warning: Undefined array key “caption” in /var/www/cshark/releases/14/web/app/themes/cshark/template-parts/blocks/image-section/image-section.php on line 37

DeFi and Blockchain’s New Era

While many commonly associate blockchain with the world of cryptocurrencies, it’s vital to recognize that the true potential of this technology in financial services extends far beyond this application.

As a form of Distributed Ledger Technology (DLT), the true promise of blockchain lies in its core features – a decentralized, immutable ledger that can revolutionize how we conduct, record, and verify transactions. This financial services technology is fundamental to the evolving field of Decentralized Finance (DeFi), which is promising to create a more accessible, efficient, and fair financial system.

The implications of blockchain technology are vast and continually unfolding, making it a vibrant arena for innovation and growth. As an example, DeFi is leveraging blockchain to disrupt traditional financial systems, replacing the need for intermediaries with peer-to-peer networks.

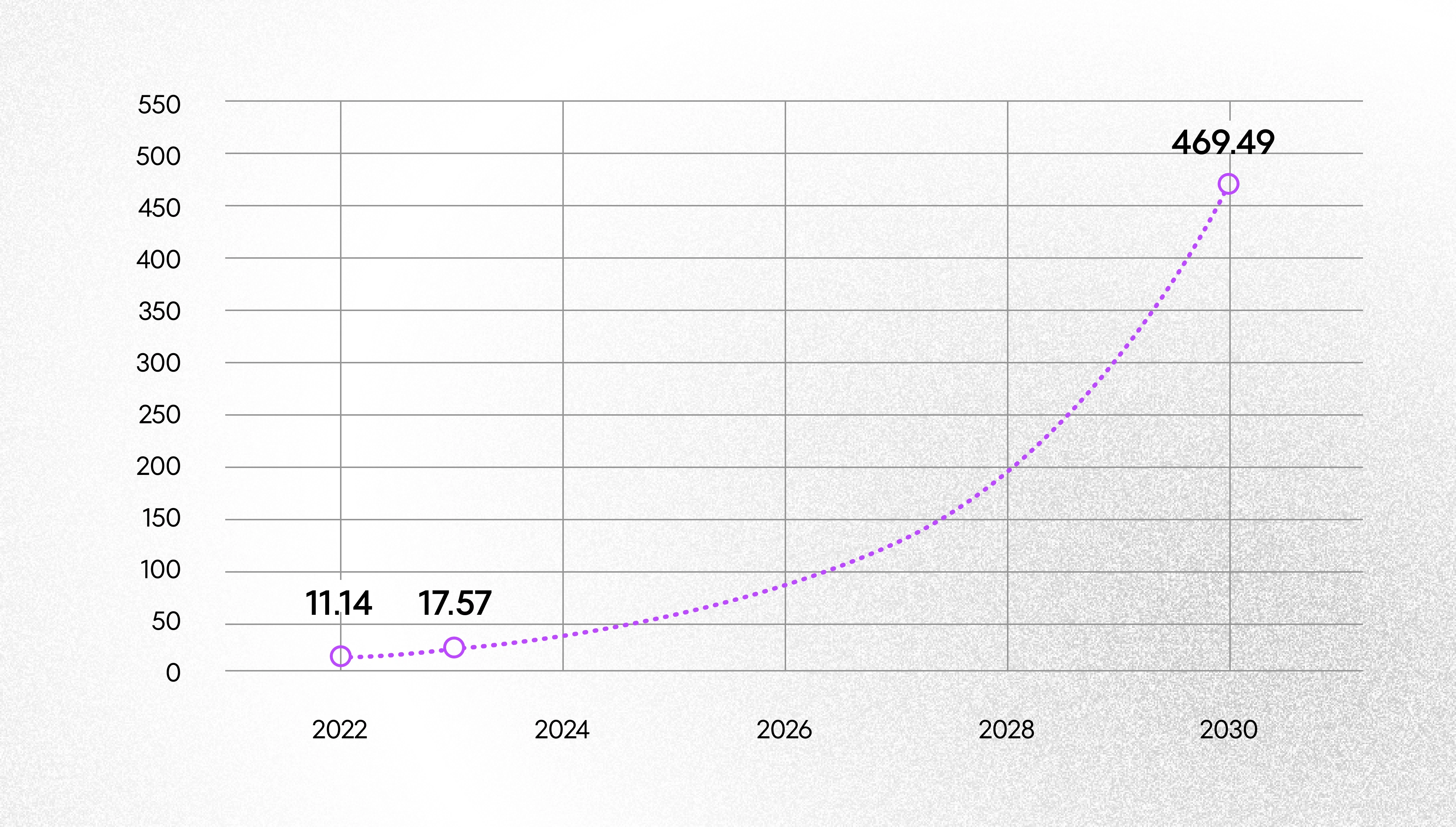

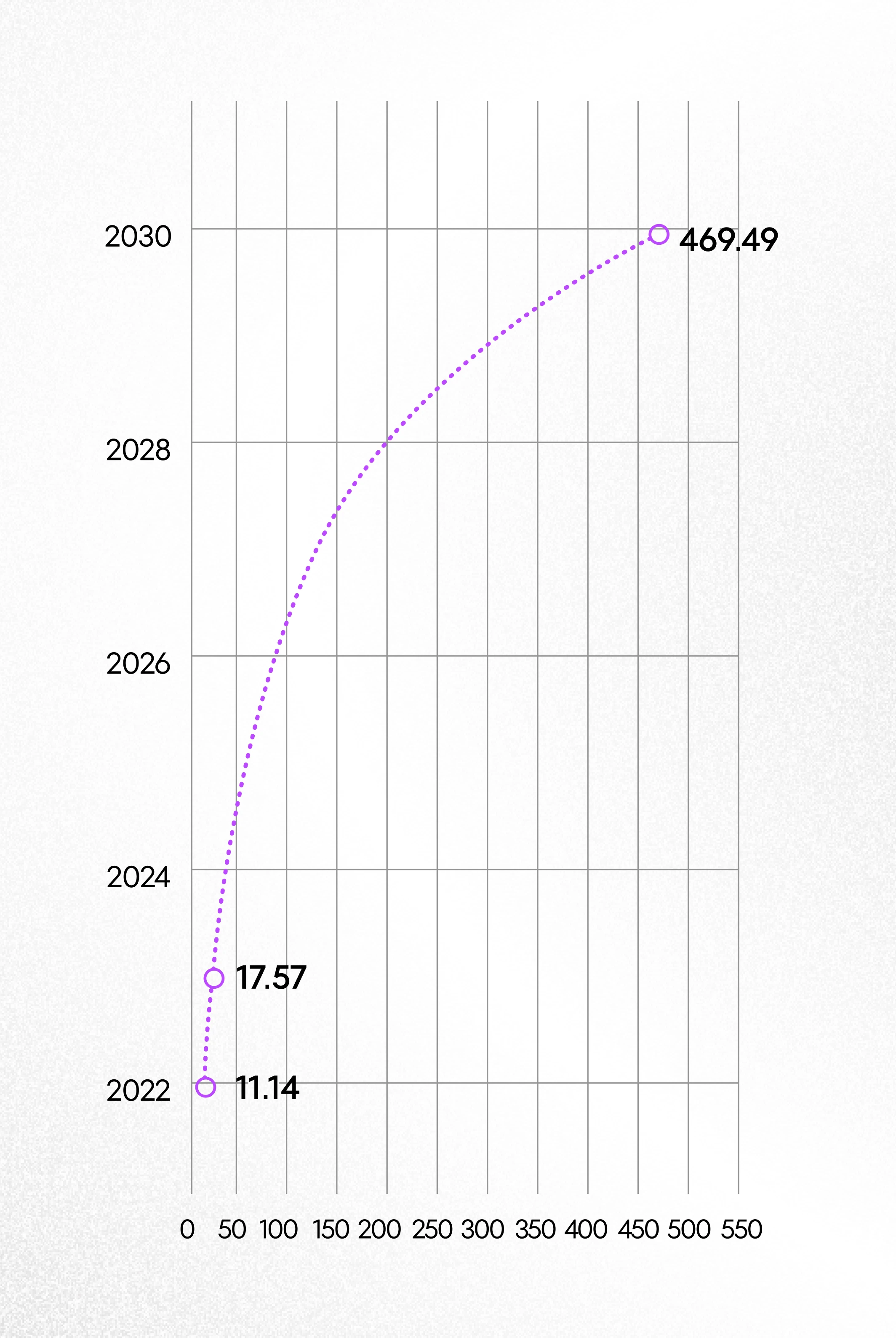

Following a robust research methodology involving data triangulation and primary research, Fortune Business Insights projected the global blockchain market to surge from its current value of $17.57 billion in 2023 to reach USD 469.49 billion by 2030. Notably, North America is expected to account for a substantial market share, marking a fertile ground for innovation and investment in blockchain and DeFi.

The global blockchain technology market size (Billion USD)

Warning: Undefined array key “caption” in /var/www/cshark/releases/14/web/app/themes/cshark/template-parts/blocks/image-section/image-section.php on line 37

Adoption of Blockchain and DeFi

The future of FinTech and RegTech is set for a dynamic shift with the escalating adoption of blockchain and innovative strides in DeFi, fostering heightened transparency, efficiency, and inclusivity.

Within FinTech, blockchain can profoundly streamline routine procedures, particularly cross-border transactions, by bypassing intermediaries. This not only accelerates transaction processes but also curbs associated costs, thereby promoting global financial inclusion. In parallel, DeFi holds the promise to democratize access to a comprehensive suite of financial services — from lending and borrowing to insurance and asset trading, irrespective of geographical and financial barriers.

Turning to RegTech, distributed ledgers offer an immutable and transparent record of all transactions, facilitating real-time monitoring and automated audits. Moreover, the emergence of smart contracts – self-executing agreements with terms directly encoded – can streamline regulatory compliance. This initiates a transition from after-the-fact regulatory compliance assessments to instantaneous verification, ensuring prompt conformity with regulations, reducing the risk of non-compliance, and easing administrative overheads for businesses.

Blockchain Adoption for Fragile Data

As the potential of blockchain technology becomes more widely recognized, it’s conceivable that regulators mandate its use for managing certain types of fragile data. This could apply to sectors where data integrity is critical, such as financial services, healthcare, or governmental records.

Regulators might advocate for this move to increase the security and reliability of data management, leveraging blockchain’s inherent immutability. The notion of a single, indisputable version of the truth could be a powerful tool to combat fraud, falsification, or accidental data corruption. Yet, mandating this shift requires meticulous evaluation of the technology’s readiness, impact on stakeholders, and ethical and privacy implications. Though possible, this decisive adoption would mark a substantial recognition of blockchain’s potential in bolstering data security and integrity.

Challenges and Constraints in the Pathway to Blockchain and DeFi Adoption

Despite the promising prospects, the road to widespread adoption of blockchain and DeFi is not without its hurdles. Key challenges arise in the realms of regulatory uncertainty, user trust, accessibility, and environment:

- Regulatory Ambiguity: The lack of clear, universal regulatory guidelines for blockchain and DeFi creates an uncertain business environment. Regulatory standards need to strike a balance between fostering innovation and ensuring consumer protection, financial stability, and adherence to anti-money laundering (AML) and know-your-customer (KYC) norms.

- User Trust and Understanding: Blockchain’s complex nature and existing misconceptions challenge user trust. Additionally, high-profile cryptocurrency frauds and hacks have stirred controversy. As such, it’s crucial to elevate public awareness, tighten security, and increase transparency for trust development.”

- Financial Inclusion: Although blockchain and DeFi have the potential to foster financial inclusion, barriers like the digital divide, restricted internet access, and technological literacy could impede universal participation. Ensuring equal adoption, especially in underdeveloped regions, presents a considerable challenge.

- Environmental Sustainability: The widespread adoption of blockchain and DeFi presents an environmental challenge due to their high energy consumption. Aligning with ESG principles necessitates the development of energy-efficient solutions to ensure their sustainable future.

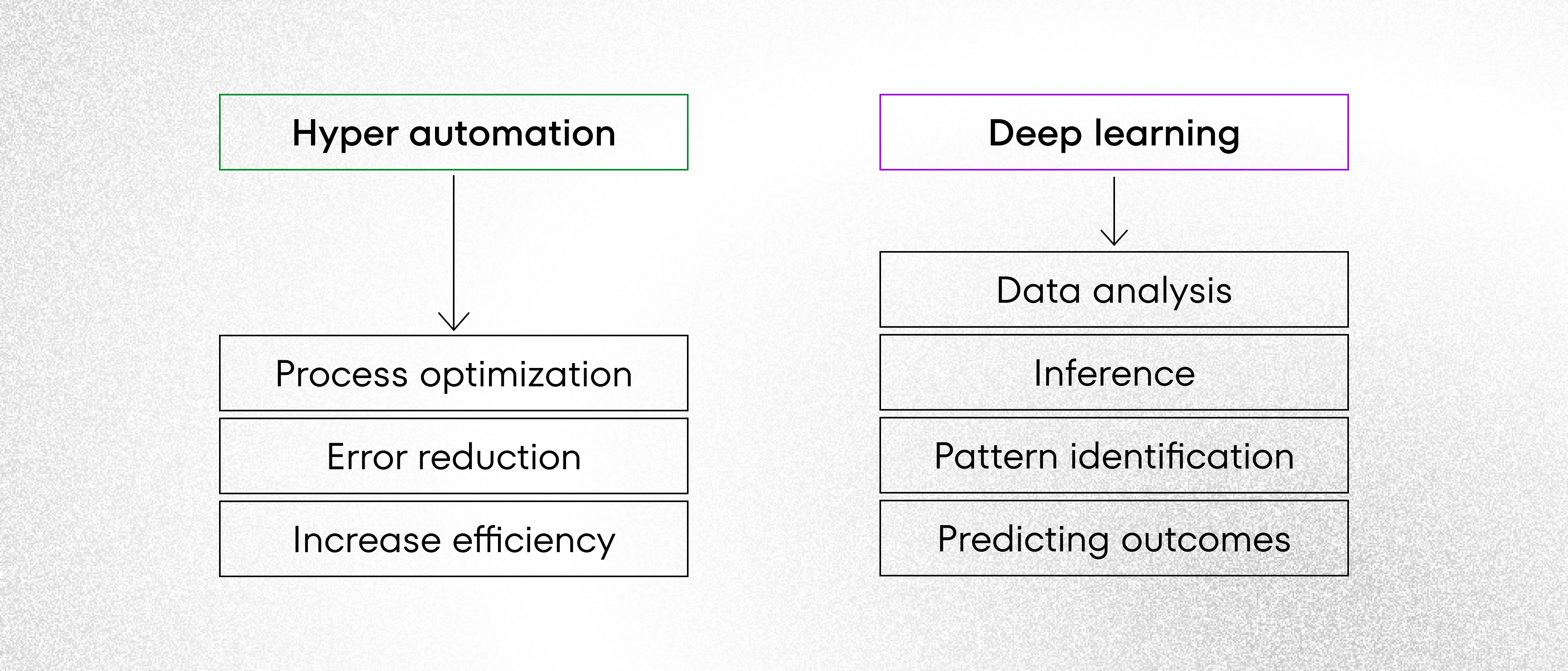

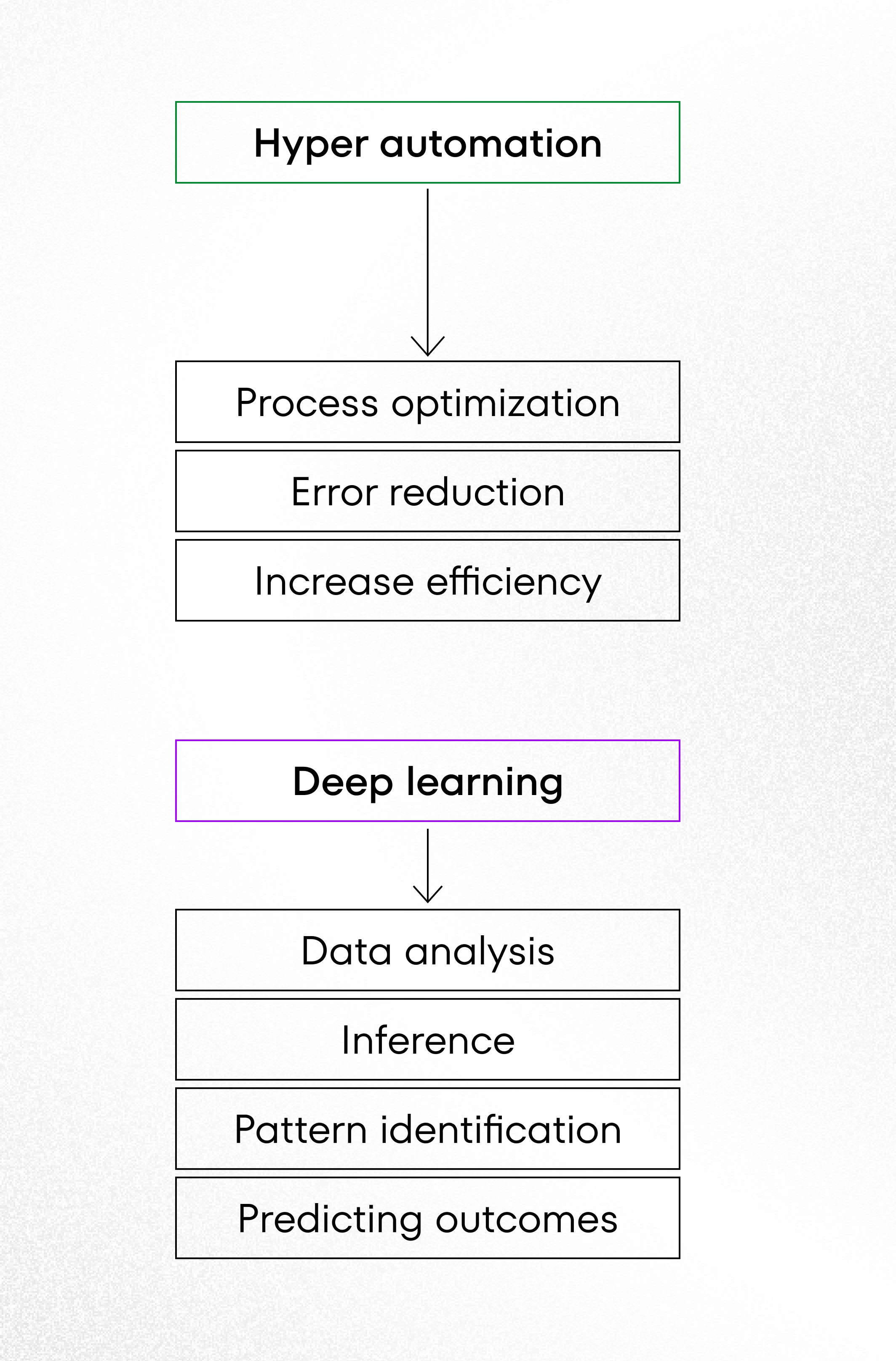

The Potential of Hyper Automation and Deep Learning

Two technologies that stand poised to become primary contributors within FinTech and RegTech are:

- Hyper Automation: a compelling fusion of AI, ML, and Robotic Process Automation (RPA)

- Deep Learning: a refined subset of ML using artificial neural networks to replicate human decision-making.

Both have the potential to bring to the table considerable improvements in operational efficiency, error reduction, and analytical sophistication within these institutions.

The overall ascending trajectory of Hyper Automation is clear, signifying its value: reduced human errors, decreased operational costs, faster processing times, and enhanced customer experiences. A significant illustration of its impact can be seen in HSBC’s implementation of this financial services technology.

As one of the world’s largest banking and financial services organizations, HSBC employed Robotic Process Automation (RPA) to enhance efficiency and minimize human errors in their back-office operations. Software bots automated tasks such as customer data verification and validation, which was previously a manual, time-consuming, and error-prone process. The bots expedited the operation by accurately cross-referencing customer data against various databases, such as regulatory lists and internal databases, ensuring regulatory compliance and mitigating the risk of errors. This initiative significantly streamlined the customer data validation process and resulted in faster customer onboarding, improved operational efficiency, and greater data accuracy.

However, minor dips reflect possible obstacles, such as the need for initial investments in technology and training and the process of refining and tailoring automated systems for specific business needs.

Deep Learning’s overall trend stems from its undeniable potential to augment human capabilities in credit scoring, risk assessment, and fraud detection. Consider its role in the latter: by analyzing transaction patterns, Deep Learning can pinpoint anomalies, significantly improving detection capabilities.

We anticipate a steady climb, underpinning its promise in refining critical FinTech and RegTech functions. The occasional slower growth rates highlight its challenges, including the requirement for extensive data sets to learn from, the complexity of its models, and the ongoing need for human oversight in decision-making processes.

The potential of hyper automation and deep learning

Warning: Undefined array key “caption” in /var/www/cshark/releases/14/web/app/themes/cshark/template-parts/blocks/image-section/image-section.php on line 37

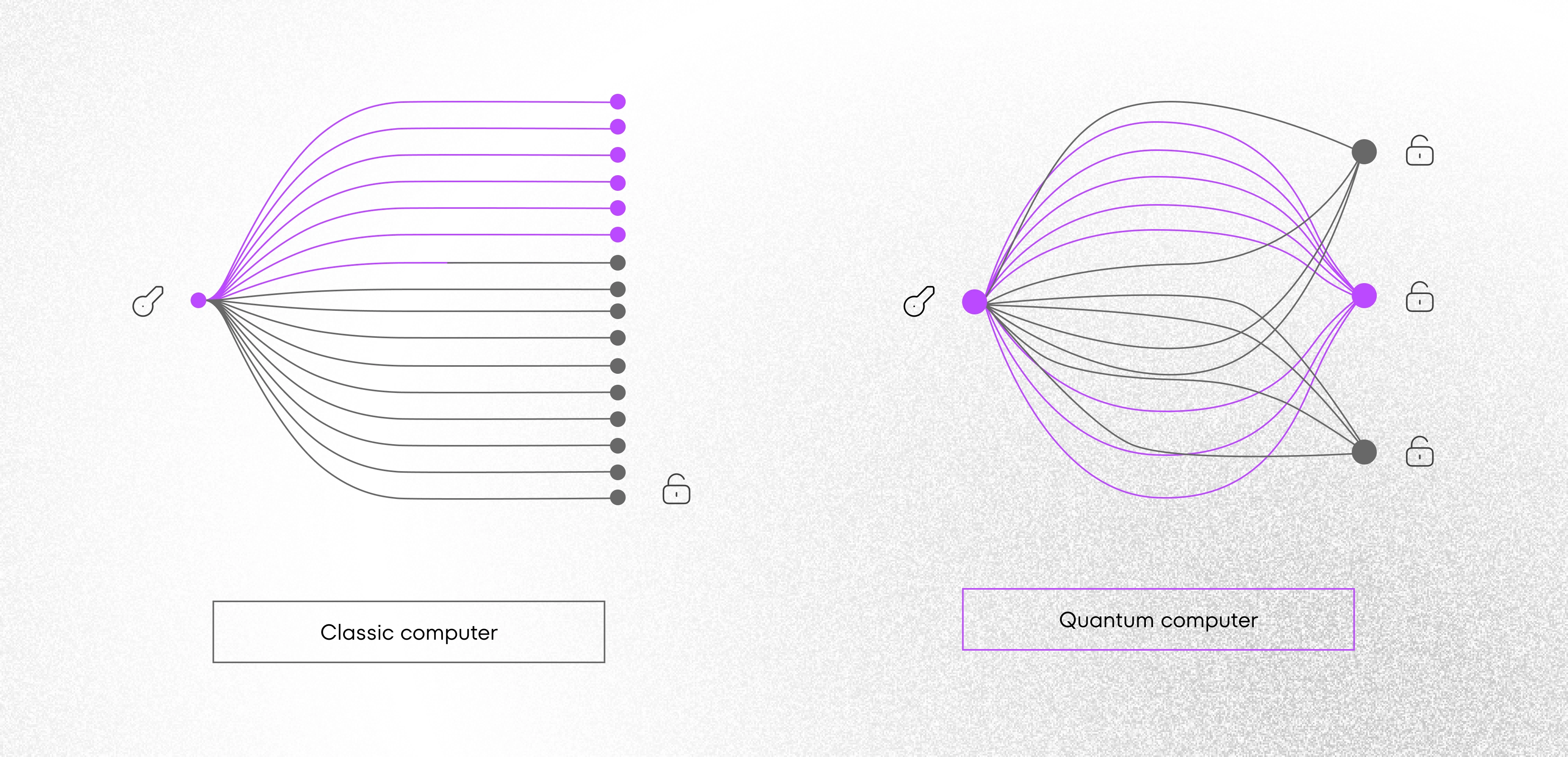

Quantum Computing

While quantum computing is emerging as a potential game-changer in the tech landscape, it’s important to note that this technology is currently still largely experimental and confined to labs. Its unprecedented computational prowess hints at a future where it could supersede existing cryptographic techniques and redefine big data analytics, signaling a pivotal disruption in the realm of FinTech and RegTech. However, translating this potential into wide-scale, real-world applications is a vision that awaits fruition as the technology matures.

From Security Enhancement to Predictive Revolution

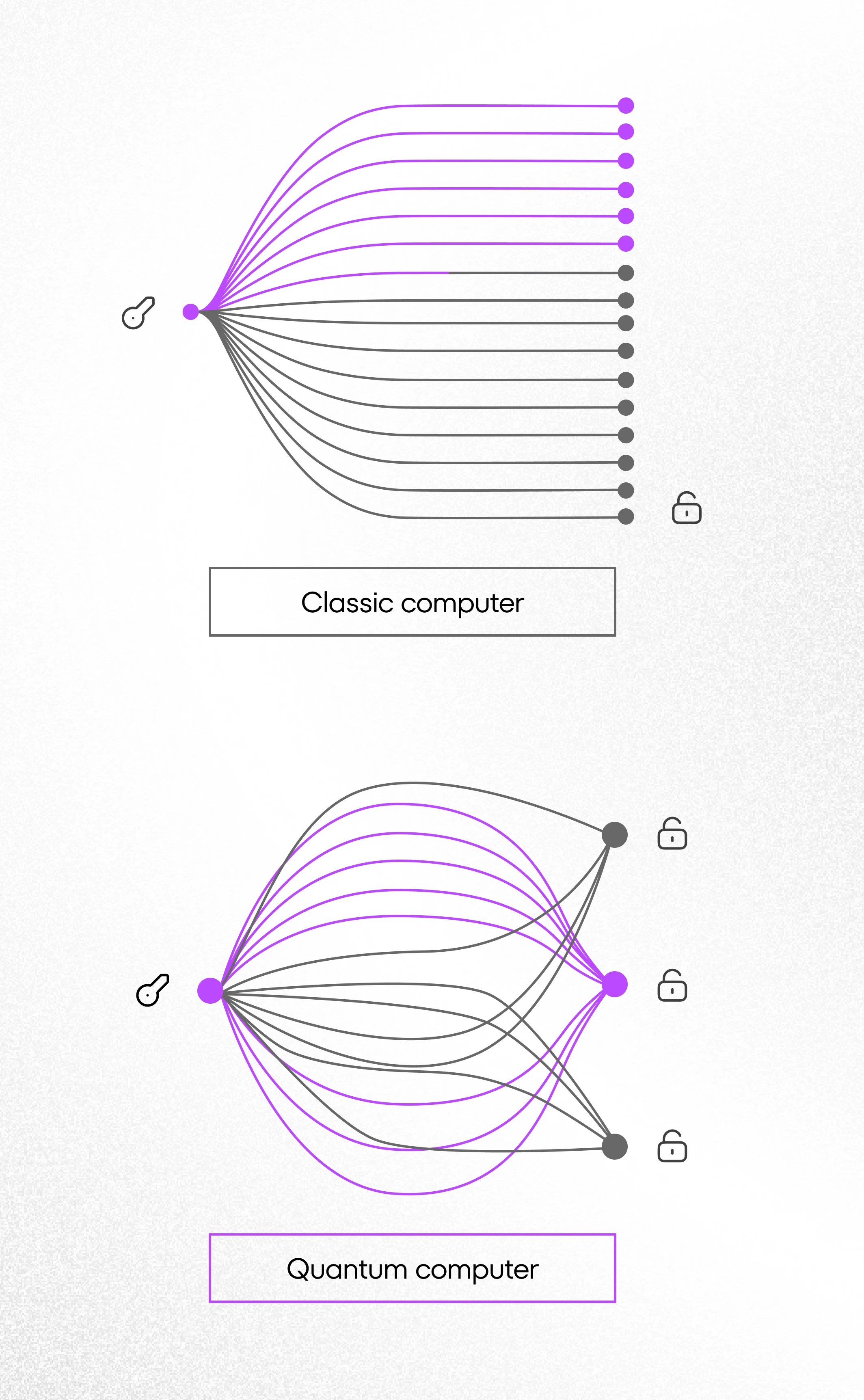

The biggest impact of quantum computing in FinTech and RegTech is predicted in the area of security, and it’s fair to say that this technology is a double-edged sword. To avoid getting cut, the only way out is to shift and modernize.

A new level of security

Quantum computers of the future will be able to crack most of the encryption algorithms currently used in digital communications and data storage alarmingly too easy. However, what constitutes a threat is also an opportunity to enhance security. Cutting-edge encryption methods available through quantum computing will offer an unprecedented way to shield transactions and data, a level of protection beyond the reach of conventional algorithms. The approaching era of high-speed, high-capacity computing necessitates urgent reinforcement of our digital defenses using robust techniques resilient to this new power, a task already underway to counter potential threats. Whether we want it or not, quantum computing will be a key driver to modernizing legacy products.

Password cracking attempt

Warning: Undefined array key “caption” in /var/www/cshark/releases/14/web/app/themes/cshark/template-parts/blocks/image-section/image-section.php on line 37

Real-time predictive analysis

Beyond the immediate focus on security, quantum computing’s influence promises to extend to predictive analysis and simulations. The technology’s unmatched processing speed and aptitude for managing complexity could revolutionize accuracy in predictions and enable real-time financial modeling. The most prominent example here is option pricing which involves computationally intensive tasks, such as solving partial differential equations or conducting Monte Carlo simulations. Quantum computers can perform certain mathematical operations, such as matrix manipulations, more efficiently, potentially reducing the time required for option valuation. This can potentially enable more accurate pricing models for derivatives and options, leading to more precise risk assessment and hedging strategies.

Building a Strong Foundation for FinTech and RegTech

As FinTech and RegTech shape the future of financial services, their successful integration hinges on a solid foundation. Thus, balancing innovation with operational effectiveness and regulatory compliance is critical.

Here’s how we can achieve this delicate balance.

Integrating Systems for Digital Transformation

Recognizing the imperative of digital transformation is critical. Not only does it keep companies in step with evolving customer expectations, but it also prepares them for the future. To this end, system integration proves invaluable – synergizing operations, ensuring data consistency and bolstering decision-making. This fusion of disparate systems into a unified, efficient ecosystem propels the advancement of overall operational performance, a critical step on the path to sustainable competitiveness.

Prioritizing Resilience and Security

The surge in cyber threats makes robust cybersecurity measures compulsory. The fallout from data breaches extends beyond immediate financial loss, tarnishing reputations, and compromising trust. Furthermore, resilient infrastructures, underpinned by high-availability systems, robust software architecture, and effective disaster recovery plans, provide essential adaptability and robustness. Together, these elements of resilience and security form the cornerstone of a solid foundation for FinTech and RegTech, fostering a secure and adaptable environment able to withstand both current challenges and future shifts.

Internal Transformation: The Human Element

Embracing the digital future isn’t just about integrating new technologies – it’s also a profoundly human process. The journey begins with fostering an organizational culture that values change, not as a disruption but as a pathway to growth and improvement. Effective change management strategies facilitate this transition, easing employees into the digital landscape.

Moreover, the rise of prompt engineering underscores the importance of honing new skills. As the adage goes, tools are only as good as the people that use them. Therefore, investing in continual training and upskilling becomes a critical part of the transformation journey.

In an age where new technologies and processes constantly emerge, preparing your teams today ensures they’re ready to adapt, grow, and excel tomorrow.

Do you want to know how we’ve helped many clients build strong foundations by providing R&D and technical consultancy, solving the bank’s legacy issues, and integrating existing ecosystems? Read the case study of one of our most impactful collaborations – Fenergo, a leading provider of digital transformation solutions for financial institutions. In this partnership, we grappled with the multifaceted landscape of FinTech and RegTech, transmuting challenges into avenues for growth.

The Bottom Line

As we’ve journeyed through the exciting terrain of FinTech and RegTech, one thing is clear: emerging technologies hold immense potential by 2030. Market predictions estimate that the global FinTech technologies market size alone will be worth $698.48 billion by 2030, while the RegTech market is projected to reach $40.83 billion.

Unleashing the power of AI, blockchain, hyper-automation, deep learning, and others isn’t just about staying relevant – it’s about shaping a promising future. But remember, this isn’t a solo endeavor. A solid foundation, steadfast digital transformation commitment, and embracing change courageously are integral to your journey’s success.

Now, let’s bring it down to you. In this fast-paced industry, staying on your toes is not just good advice – it’s a survival strategy. But you don’t have to conquer these dynamic challenges alone. With CSHARK as your ally, we can turn complexities into opportunities. Why adapt when you can lead, right?

Want to learn more about how you can innovate and overcome the most common challenges in your financial business? Read our e-book on the digital transformation journey in finance.

Why CSHARK?

Over the years, we’ve amassed a wealth of expertise, building cutting-edge FinTech and RegTech solutions. You can read more about our projects:

Fenergo – tech revolution in global banking

RegTech Web Application Development

FinTech – data migration and integration

Through these collaborations, we have learned to better understand the challenges of FinTech and RegTech and have developed processes to smoothly implement customized solutions.

Contact us, and let’s discover how your organization can pioneer the future of FinTech and RegTech. The time is now.